santa clara county property tax calculator

Fill out the tax credit calculator. Learn why Santa Clara County was ranked a top 40 Healthiest Community by US.

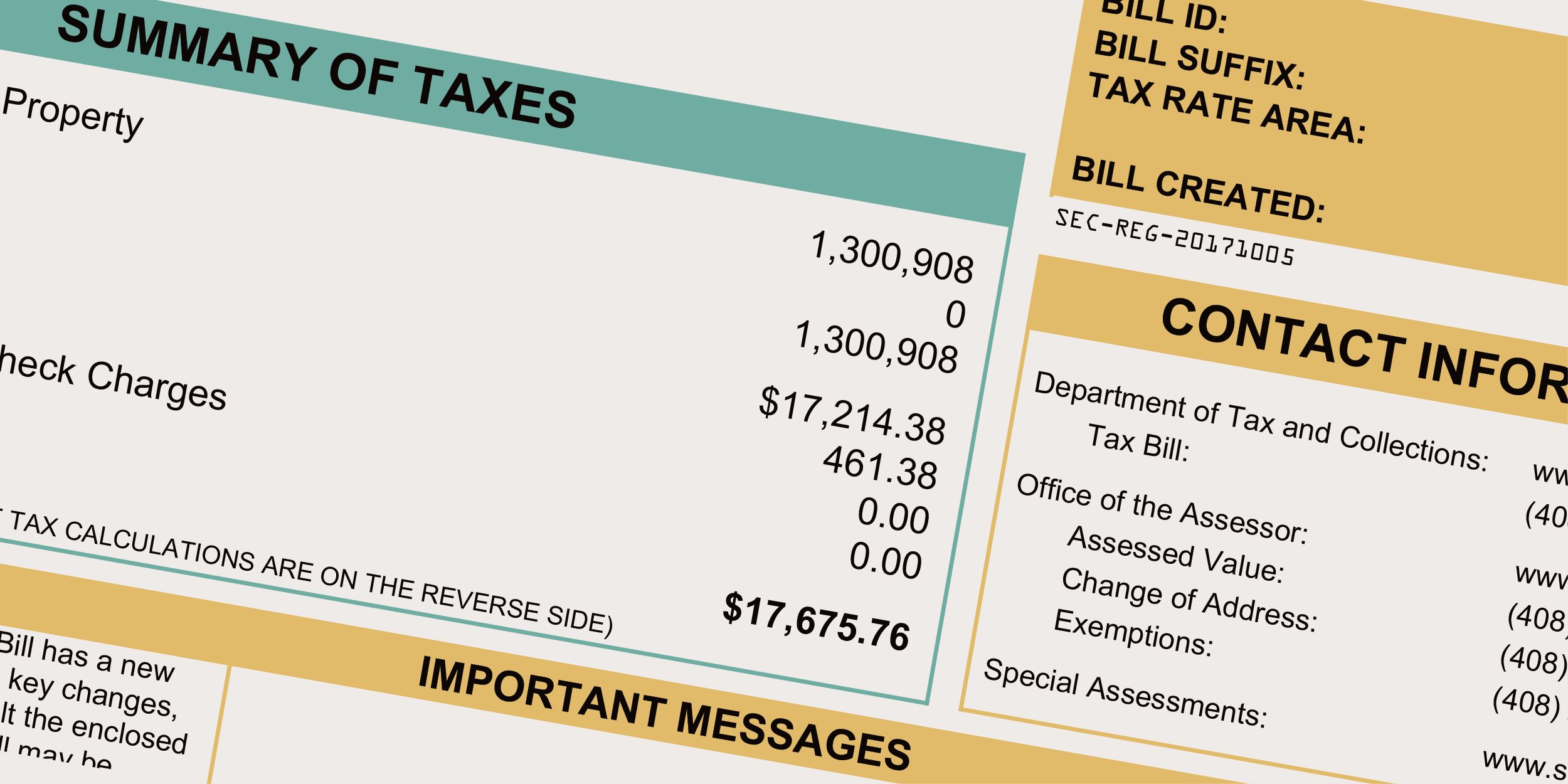

Property Taxes Department Of Tax And Collections County Of Santa Clara

Learn more about tax credits.

. Supplemental assessments are designed to identify changes in assessed value either increases or decreases that occur during the fiscal year such as changes in ownership and new. The most populous location in Santa Clara County California is San Jose. Pay Property Taxes.

Santa Clara County has one of the highest median. Owners must also be given an appropriate notice of rate. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year.

For questions about filing. Ad Unsure Of The Value Of Your Property. File for free and get money back.

News and World Report. Look up and pay your property taxes online. P the principal amount.

CDTFA public counters are now open for scheduling of in-person video or phone appointments. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. This calculator can only.

Select your county and enter income and family information. Find All The Record Information You Need Here. I your monthly interest rate.

Get your tax credit estimate. As we all know there are different sales tax rates from state to city to your area and everything combined is the. Santa Clara County Assessor Santa Clara County Assessor.

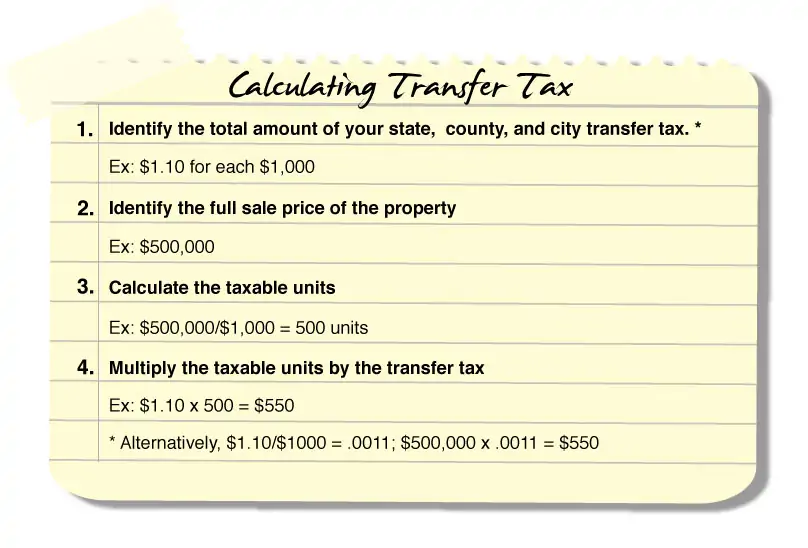

Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. The median property tax on a 70100000 house is 518740 in California. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

The median property tax on a 70100000 house is 736050 in the United States. County of Santa Clara. Learn all about Santa Clara County real estate tax.

Discover the Registered Owner Estimated Land Value Mortgage Information. Denotes required field. 70 West Hedding Street East Wing.

Welcome to the TransferExcise Tax Calculator. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property. Santa Clara County California.

The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local.

Please contact the local office nearest you. Property Tax Rates for Santa Clara County. The median property tax on a 70100000 house is 469670 in Santa Clara County.

Method to calculate Santa Clara County sales tax in 2021. San Jose California 95110. The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters.

As far as other cities towns and locations go the place with the highest sales tax rate is Alviso and the place with. Enter Property Parcel Number APN. So if your.

What You Should Know About Santa Clara County Transfer Tax

City Of Santa Clara Real Estate Market Valley Of Heart S Delight Blog

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

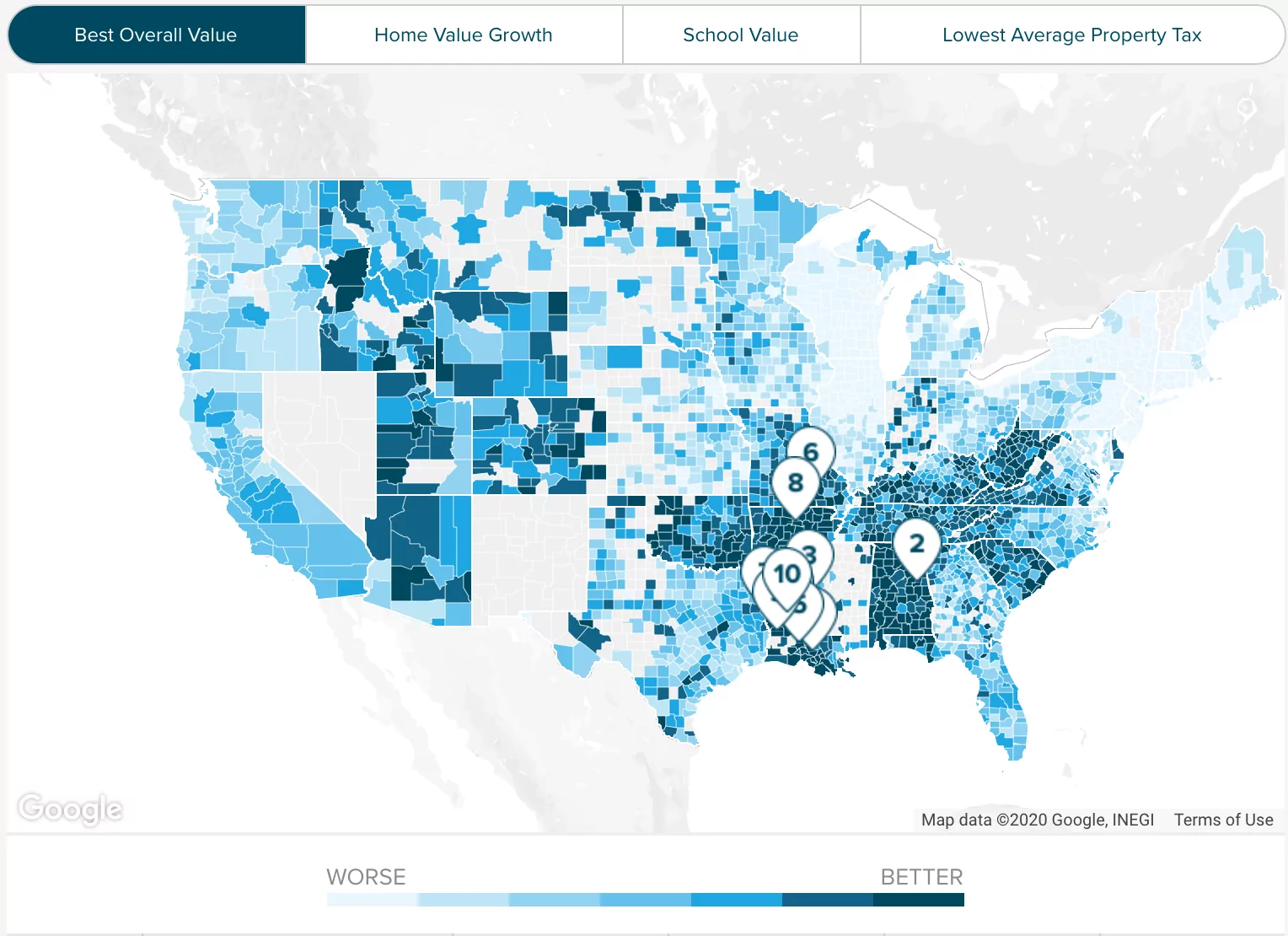

2022 Best Places To Buy A House In Santa Clara County Ca Niche

What You Should Know About Santa Clara County Transfer Tax

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Search And Records Propertyshark

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara